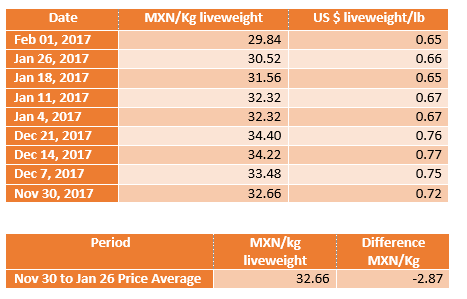

Los precios del cerdo de México han mostrado una ligera tendencia negativa en las últimas cuatro semanas, la disminución de aproximadamente 2.50 MXN pesos / kg de peso vivo. Sin embargo, durante un período de tiempo (últimas 8 semanas) más largo, la disminución es de aproximadamente 2,90 MXN pesos / peso vivo kg como se muestra en la siguiente tabla. Los productores en México creen que podría ser debido a un menor consumo interno en México y probablemente efecto estacionalidad también.

Mexico Market Report

Mexican Pig Industry is on the Verge of a New Era

Fernando Ortiz %u2013 Iberoamerican Business Development, Genesus

Mexican pork prices have shown a slight negative trend over the last four weeks, decreasing about 2.50 MXN pesos/kg liveweight. However, over a longer period of time (last 8 weeks), the decrease is about 2.90 MXN pesos/kg liveweight as shown in the table below. Producers in Mexico believe that it could be due to a lower domestic consumption in Mexico and probably seasonality effect as well.

In terms of the US Dollar-Mexico Peso exchange rate, the peso has a lower rate of 20.67 versus the high of 22.01 from last month. As we have mentioned on past reports, Mexico%u2019s currency devaluing by over 30 per cent is detrimental, but it could be worse. In the worst case scenario, producers are buying more costly imported grain than before (even when grain prices are lower in price than in the country of origin). Since the price of a country%u2019s currency affects the price of their products on world markets, the currency%u2019s exchange rate can have a big effect on national exports and costs of imports.

On the other hand, Mexican pork exporters are earning more margins by putting their product overseas. With the rise of the dollar, Mexico has enjoyed a surge in exports, especially to the US.

Mexico Current Pork Production and Foreign Trade

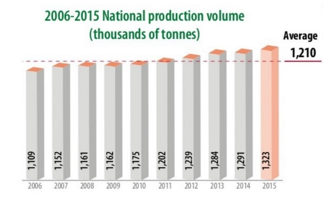

With about 1.4 million tons of pork production projected for 2016 (USDA projection), Mexico is still far from being self-sufficient. It is estimated that the consumption of pork in Mexico would increase 3.3 per cent during 2016 (even though right now we are seeing a small drop), to stand at 2.2 million tons (carcass).

Since 2012, Mexico has expanded pork exports about 30 per cent (2012, 70,000 tons %u2013 2015, 100,000 tons). Mexico%u2019s pork imports is about 1 million tons a year, for a value of more than $1.785 billion US dollars, representing 14 percent of imports of pork (meat and by-products) worldwide. The main supplier is the US, which accounts for 84 per cent of sales, over $1.5 billion US dollars. It is followed by Canada, with $250 million in value. Between both, they account for 98 per cent of the volume and value of pork imports to Mexico. Imports of pork increased one quarter in 2015, compared to the previous year; the same happened with exports, which increased by 8.6%. Japan is the main importer of Mexican pork: it buys four out every five tonnes exported.

NPPC Says Pork Exports to Canada, Mexico Critical

NPPC Says Pork Exports to Canada, Mexico Critical

After recent announcements from the Trump administration concerning trade, the National Pork Producers Council (NPPC) has stated today that they will work to preserve tariff-free market access for U.S. pork exports to Canada and Mexico.

%u201CAs far as pork is concerned, the trade deals with Canada and Mexico have been tremendous for U.S. pork producers,%u201D said NPPC President John Weber. %u201COur exports to those nations exploded because of the trade pact we have with them. But we know that some concerns have been raised by others, so we are committed to working with the Trump administration in looking for ways to improve our trade relationships with Canada and Mexico.%u201D

%u201CTrade in pork with Canada and Mexico has been so successful that any disruption in exports with either partner could hurt our producers%u2019 ability to compete,%u201D Weber said. %u201CWe need to make sure we maintain and even improve our pork exports to our neighbors while working to ensure that others benefit as much as we do.%u201D

The National Pork Producers Council has committed to work with the Trump administration to preserve tariff-free market access for U.S. pork exports to Canada and Mexico. The administration is planning to pursue trade discussions with the two countries.

NAFTA Background

NAFTA took effect Jan. 1, 1994, and under the terms of the deal, tariffs on most products traded among the United States, Canada and Mexico were eliminated. The agreement created the world%u2019s largest free trade area, with 450 million people and a GDP of more than $20 trillion. The three NAFTA nations have a greater economic output than the 28-country European Union. Since implementation of NAFTA, U.S. trade with Canada and Mexico has more than tripled, growing more rapidly than U.S. trade with the rest of the world. The countries are the two largest destinations for U.S. goods and services, accounting for more than one-third of total U.S. exports. NAFTA has added $80 billion to the U.S. economy, and U.S. exports to Canada and Mexico support more than 3 million American jobs. While imports from Canada and Mexico to the United States have increased under NAFTA, nearly 60 percent of those imports are used in the production of American-made goods. For the U.S. pork industry, NAFTA helped significantly boost exports to Mexico, which now is the largest volume market for U.S. pork and the No. 2 value market.

Through November, U.S. pork exports to Mexico in 2016 were nearly $1.2 billion, up 21 percent from the same time last year, and to Canada they totaled $731 million, making those countries the No. 2 and No. 4 export markets, respectively, for U.S. pork.

Canada and Mexico are the two largest destinations for U.S. goods and services, accounting for more than one-third of total U.S. exports, adding $80 billion to the U.S. economy and supporting more than 3 million American jobs, according to data from the Office of the U.S. Trade Representative. In fact, U.S. manufacturing exports to Canada and Mexico have increased nearly 260 percent over the past 23 years, and U.S. farm exports to the countries have grown by more than 150 percent.

Sources: 2016 Food and agricultural Atlas SIAP, National Pork Producers Council (NPPC), US International Trade Commission, Porcicultura.com.

Categorised in: Featured News, Global Markets

This post was written by Genesus

Fuente: Gensus